Cash App For Business [The Perfect Guidance]

The Cash App for business got introduced in 2015 to aid and assist companies in accepting online payments from customers. The experience for business users remains similar to that of an individual user.

The advantage of having the Cash App business account is that all the major providers of corporate brands now can accept online payments from their clients. Another benefit is that customers who are not Cash App users can also transfer the payments to exchange for services and goods.

This blog has covered all the necessary information on Cash App for Business, including its fees, limits, and use of having a business account, and a short comparison between Cash app personal and business account.

We’ll now look at how to make use of a Cash App Business Account.Cash App allows an easy sign-up process for both users to sign up, i.e., an individual and a business. The user must create a personal account first and afterwards switch his personal account into a business account.

Also, Learn: How To Install Cash App Yourself On Your Device.

Table of Contents

How to Set Up a Business Account on Cash App?

As mentioned above, there is a single sign-up process for the Cash App account setup. First of all, users will need to create a Personal Account, and afterward, they can switch their Personal account to the business.We will discuss the detailed steps to create a personal account on Cash App in the next section.

How to Create A Personal Account on Cash App?

If you are pretty new to Cash App and looking for assistance with the Cash App account creation, the step-by-step points are described below in detail.

- Download Cash App on your mobile

- If you are using a Cash App for the first time, you’ll have to input a telephone number or an email login ID to receive the code. Then, you will receive a code to verify your account.

- Verify your account just by entering the code received from Cash App.

- After verification, select whether to add a bank to the Cash App immediately or wait until you can add it later. To add a bank account, it is necessary to enter the debit card’s number and the name exactly as it appears on your card.

- Select a $Cashtag that is your identifier for Cash App. You can also use $CashTag for getting money paid from someone. A $Cashtag should contain at least one letter and up to 20 characters.

How to change the Cash App Personal Account to a Business Account?

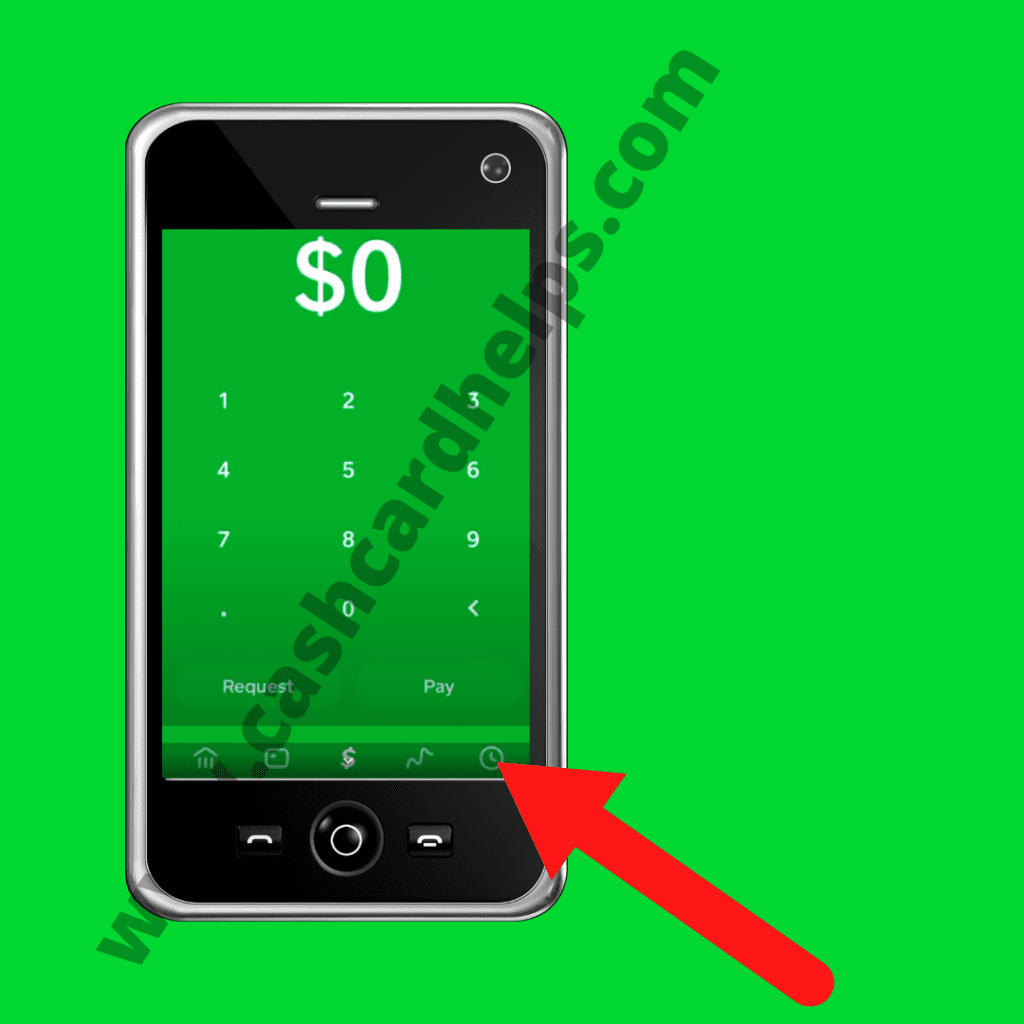

- Log in to your Cash App account.

- Click on the activity “Icon.”

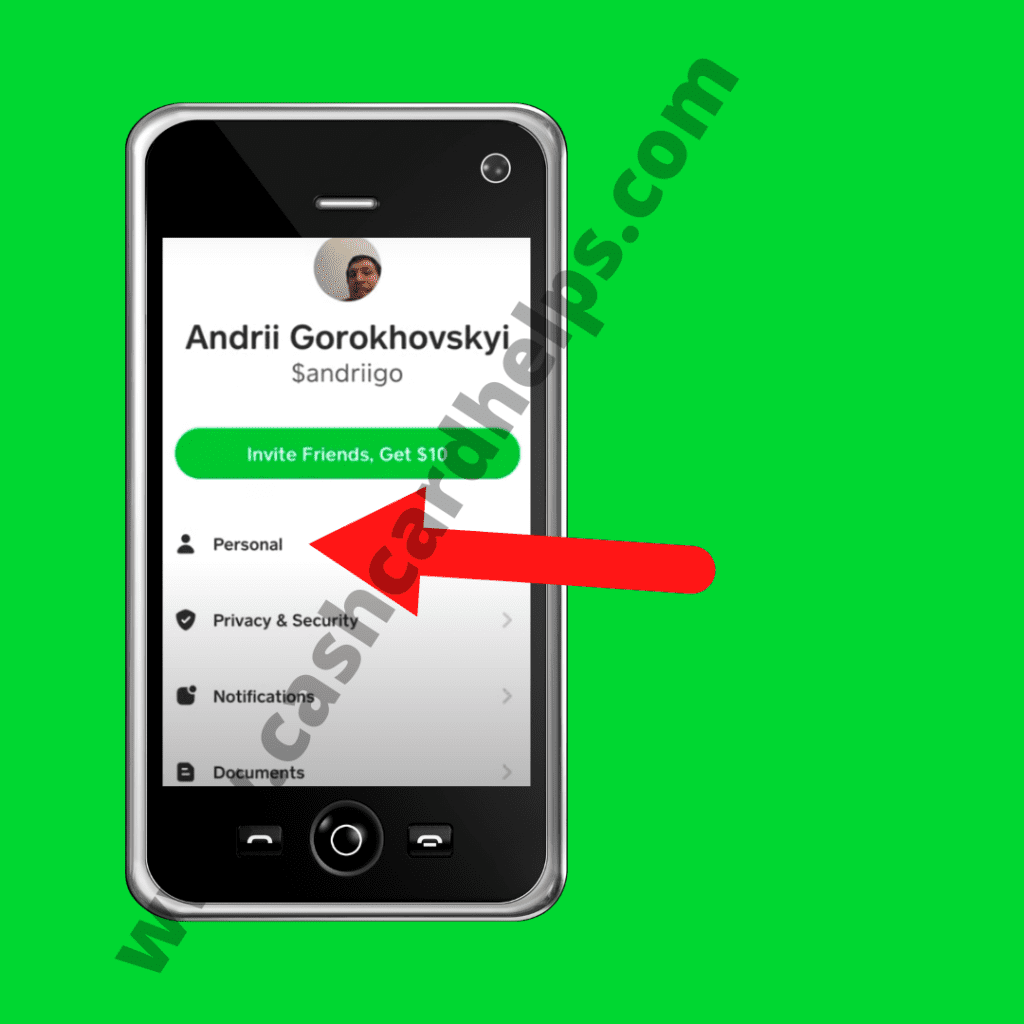

- Now, click on the “Personal” option.

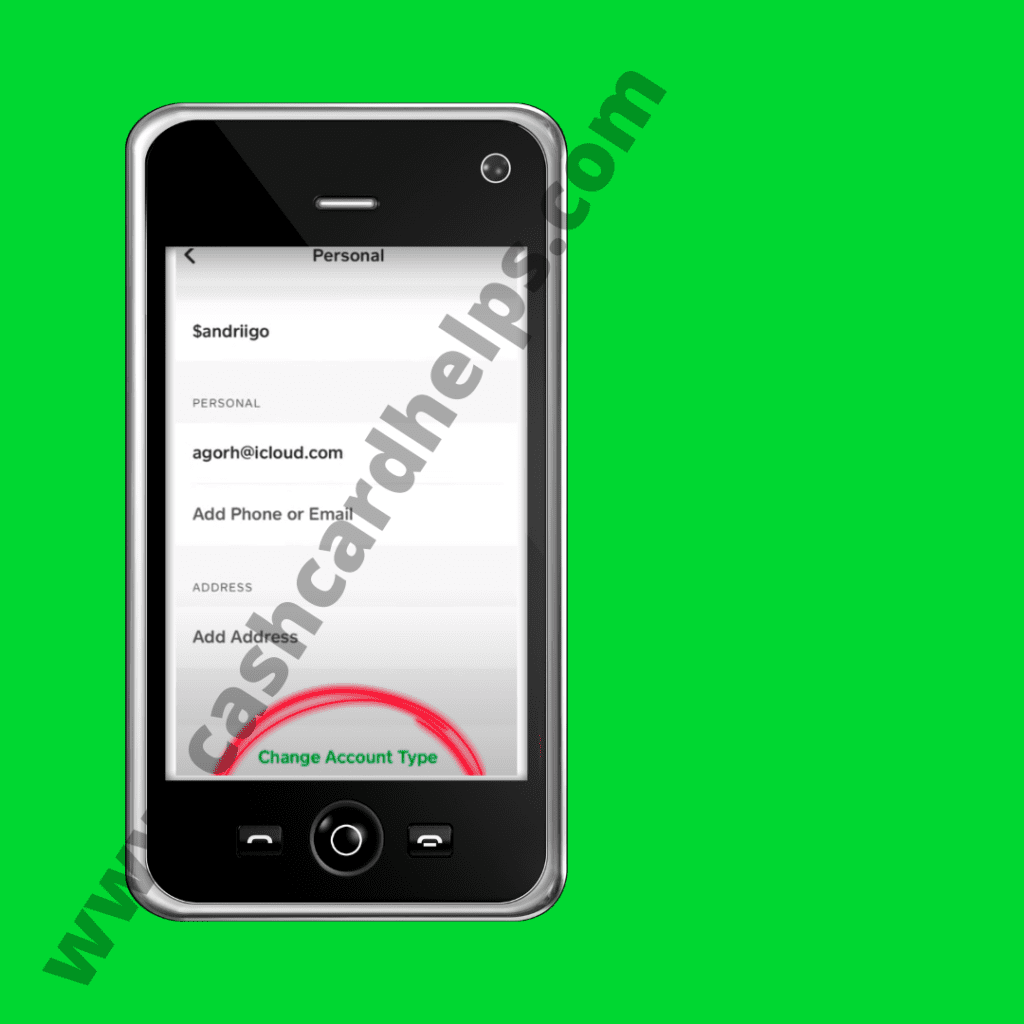

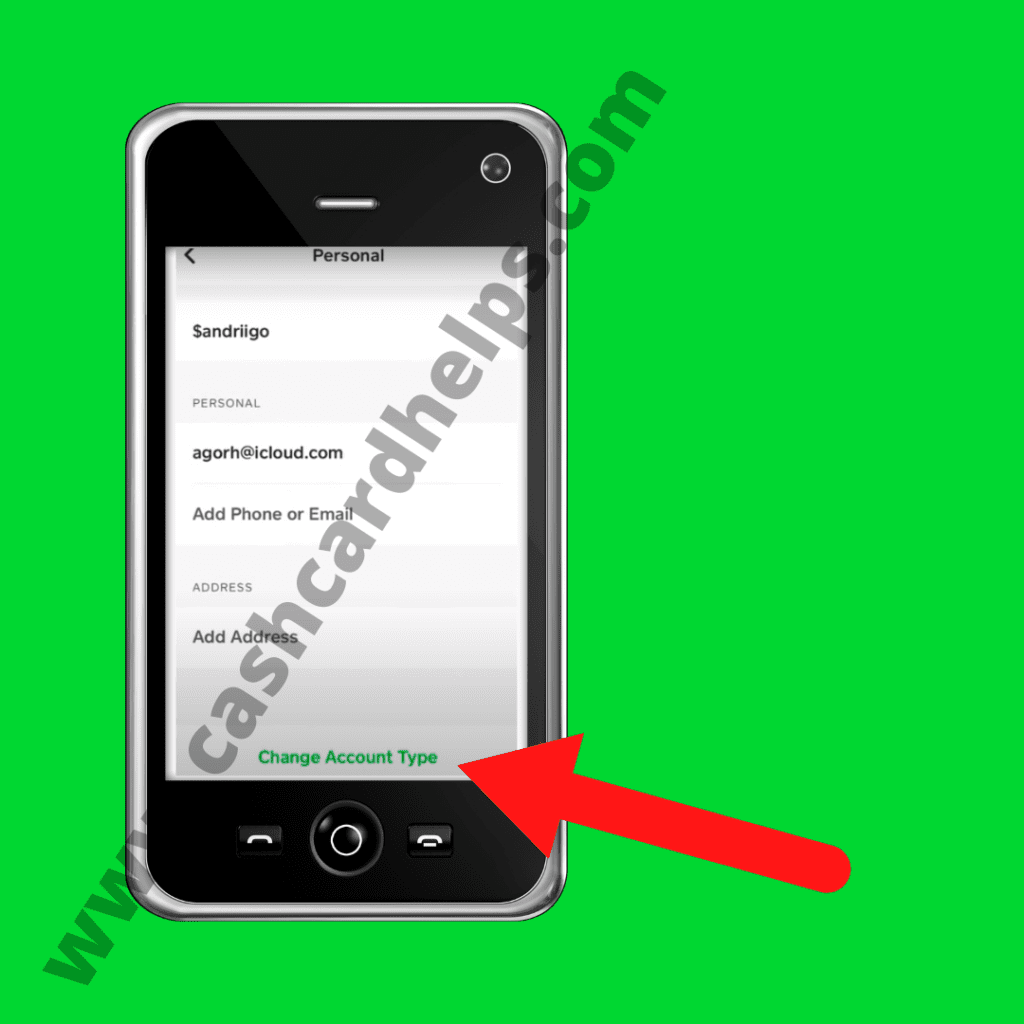

- Scroll down; the user will see the “Change account type” option.

- Click on the “Change Account Type” option.

- Now the app will prompt users by displaying “Cash App for Business” involved fees, and below, you’ll see “Change This Account” and click on it.

- Finally, Click on the “Confirm” to change your account.

What is the fee for a Cash App Business Account?

It does not cost anything to create, set up, and manage the Cash App for business accounts. At the same time, Cash App Visa debit card orders and activations are also free of charge. Cash App charges a fee of 2.75% for every payment received. If you choose instant transfers, sending money from a business to a linked account could cost you 1.5%. However, Standard bank deposits are free.

Additionally, Cash App may charge up to 3 percent for payments made with a credit card. Users can create a unique payment URL and share the same without any additional charges.

What are the limits for business accounts on Cash App?

Cash App for Business account holders can receive money without any limitations. Also, there is no limit on the total number of transactions you make. Certified business account holders who have confirmed their identity may send up to $7500 per week.

Here we attract the kind attention of our readers to go through our recently published post on How To Increase Cash App Limit.

What is the difference between Cash App Business and Personal Accounts?

Cash App is available for both personal and business accounts. However, both types of users can use Cash App to make easy payments. Both account holders can easily link their bank accounts with debit and credit cards to make easy payments: $cashtag, cash boost, and Cash. Link is available for all Cash App users. Cash App has provided some features to help small business owners get paid quickly.

Now, the real question is how does Cash App distinguish between business and personal accounts? Here’s the reality:

- Cash App for business accounts allows merchants to receive unlimited funds from their customers. Cash App charges just 2.75% per transaction when a business owner receives money through their business account. For personal accounts, you don’t need to pay anything to receive money from your contacts.

- The best part of the Cash App business account is that the merchants can create their own payment links and share them with their customers. This payment link is the best because it allows anyone to pay without installing Square payment and opening a new Square account. Not only that, but if your website has a payment link, you can attach it to your website and instantly receive your money.

- In addition to this, a standard bank deposit is also free for business account holders. Instant deposit via Cash App is available for both business and personal accounts. The minimum deposit fee is 1.5%

What is the use of a Cash App for a business account?

Anyone can open a Cash App business account. We all know that carrying cash isn’t always possible for everyone. A large percentage of people prefer to pay electronically, thanks to the growing use of internet services and smartphones. The idea is to embrace online payment systems and get ahead.

- There is good news: you don’t need to implement a complex payment system in your company. There is no need for you to spend large sums of money. All you need to do is download the Cash App and then create a Cash App account. When asked for the type of account you want, ensure you select a Business account.

- Your business account is a way to get the cost of the products and services to customers. If necessary, you can send a request to your customer for a refund. If you want, you can also send your customer a request for the amount that is pending.

- Business account holders who do more than $200 transactions and receive money up to $20000 will be issued a 1099-K form for reporting and paying taxes.

Benefits and Drawbacks of Square Cash App Business Sign Up

It’s a simplified variant of Square POS; Cash App is ideal for small-scale companies that don’t require or desire a lot of additional features and can’t manage large volumes of transactions. Signing up is easy, meaning you can accept debit and credit card transactions within a few minutes.

Paying for your purchases is easy, as well. No additional equipment is required, not even a swiper for credit cards. All you need is your account and a #Cashtag. Customers who have Cash App accounts can look up your business using $Cashtag or email address, as well as a phone number to make payments through the app, and you can also make requests to the Cash App users. The cash. me link extends the capabilities by the ability to pay anyone online with a credit or debit card.

Utilizing Square Cash for Business allows you to accept more payments without the requirement for an account for merchants or a pricey payment processor. It is a good option for those who are just beginning their journey and aren’t able to afford a complex POS system or, in the case of a business that specializes in small-scale online sales.

However, using the Cash App for business rather than a more robust option comes with a few disadvantages:

- The payment amount is only $1000 per calendar month (unless you confirm your account by providing more precise personal details like SSN, Driver’s license etc.)

- Payments from outside the country cannot be accepted or made.

- Businesses cannot use the Square Cash Visa debit card or its “Boost” discounts.

- Customer Support is available only through email or social media.

- Square can hold the funds in your account or close it should it be deemed necessary.

After you’ve started consistently crossing the $1,000 mark per month on sales, you’ll be required to either supply Square with your complete name, birth date, and the four last numbers of your social security numbers to raise your limit or upgrade to an enhanced POS system.

Which are the top alternatives for the Cash App Business account?

Zelle

Zelle provides free funds transfers for small businesses, and they can use the app for payment if their company accounts are compatible with the integration. Users can transfer and get funds without paying fees, usually arriving in minutes. However, the Zelle payments are limited only to the U.S., and you’ll need to calculate your tax-deductible income.

Venmo

Venmo’s business accounts permit customers to transfer money or make use of debit cards for paying. The app will charge each business transaction 1.9% plus 10 cents. However, users can enjoy the usual Venmo charges waived when they use this app to pay businesses, making it at no cost to send your cash. Additionally, users can look up your account with the business name or use a unique QR code to navigate right to the page for payment.

PayPal

PayPal allows users to select between paying for their purchases using a credit card or paying with “buy now, pay later” and provides an in-person point of sale option through Zettle, the Zettle credit card reader. The processing time for payments can be longer than other competitors, but the application offers monthly payments and free invoicing, allowing customers to contact them quickly. Rates for transactions differ based on the payment method, with the cost of 2.99 percent and 49 cents on credit card transactions.

Before we wrap this post on Cash App for Business, we want our readers to see a short video presentation on How to Place Custom Orders for Stocks & Bitcoin on Cash App.

CONCLUSION

In this article, we have provided the complete information you need on Cash App for Business. At the same time, we also have discussed fee structure, money sending limit, and the business account use in the Cash App.

If you still have any questions in your mind, you can directly contact us.

FREQUENTLY ASKED QUESTIONS

How much is Cash App Business Account Fee?

Cash App for business accounts charges 2.75% for receiving money. However, it is entirely free to set up a Cash App for business. There is also no charge to order and activate your Cash Card, a VISA debit card linked directly to your Cash App wallet.

How can Cash App benefit your business?

- You can offer more than one payment option.

- It would help if you made it as easy as you can to pay.

How to switch Cash App Personal to Business account?

Follow the below steps:

- Open the Cash App on your phone and log in to your account.

- Click on the Profile button.

- Scroll down and Tap on the Personal tab.

- Select “Change Account Type”.

- To confirm the changes, enter your PIN or scan your finger.