Cash App Investment [Beginner’s Guide]

Cash App, in particular, has gained a lot of attention as being the most reliable payment application. In recent times, the Cash App has grown beyond a simple money transfer application. It’s emerged as an investment App too. Hence, these questions are frequent in the user’s mind: Is Cash App good for Investing? How to invest money using Cash App investment?

The Cash App Investment platform was introduced in late 2019 as a compelling investment option for the App. Since then, people have started making more use of the Cash App wallets besides the basic functionalities of sending and receiving money.

Most of us are already aware that users can trade with Bitcoin and Stocks through the Cash App Investment. But many users do not know how Cash App investment works. Before you can put your money into investing through Cash App Investment, it is crucial to be aware of the essential facts about cash App Investment.

Table of Contents

Is Cash App good for Investing?

It’s true that at some point or the other, everybody invests money. Investment is an art, and a successful investment requires a lot of knowledge and planning. It also requires determination, patience and indeed money. Experts suggest that you start investing with small steps. And here, It’s good to know that your favourite payment application, Cash App, can be your best partner during your initial investment journey.

Of Course, Cash App could be the perfect choice to begin your journey to stock trading. The best part is that those passionate about Bitcoin can also purchase and sell BTC without worry. It means that you can invest in two different ways without any fear of fraud on the internet by using Cash App Investing.

It is essential to note that Cash App is primarily known for its peer-to-peer money transfer application. Additionally, it provides an easy, fast and straightforward way to invest money in stock and BTC. The Investment section of the app is not in-depth and extensive. However, it can be suitable for beginners who like to invest a small sum of money.

How does Cash App Investment Work?

We all know that investing is among the most lucrative sources of income and is an art for the right investors. However, investments are susceptible to risk. Here’s a brief overview of Cash App investment.

Cash App investment is a way that verified Cash App users could make investments in shares and Cryptocurrency via the Cash app’s website and the mobile application.

There are two options of investing your money through Cash App.One is to buy, store or sell Bitcoin. The other is stock trading.

Cash App Stock: A verified Cash App user can buy or sell stocks using their account balance. Cash app lets its users the option of investing from the lowest price.

Cash App users can start the investment as low as one dollar and invest their money into fractional shares. Moreover, the Cash App does not charge fees for the purchase or sale of stocks.

Bitcoin Investment on Cash App: Verified Cash App users also have the benefit of investing in Bitcoin. Bitcoin is one of the most well-known and most sought-after cryptocurrencies in the world.

Also, Learn How to Buy and Sell Bitcoin on Cash App.

How to Buy Stocks on Cash App?

Here are the steps to buy Stock through Cash App Investing:

- Open Cash App and log in to your account.

- Tap on on the Investing tab.

- Scroll down and discover the stock wherein you want to invest.

- Choose the stock and tap on it.

- Click on the Buy option.

- Enter the amount and tap on the “Next” option.

- Click on the “Continue.”

- Select your “Employment Status” and tap the “Next” button.

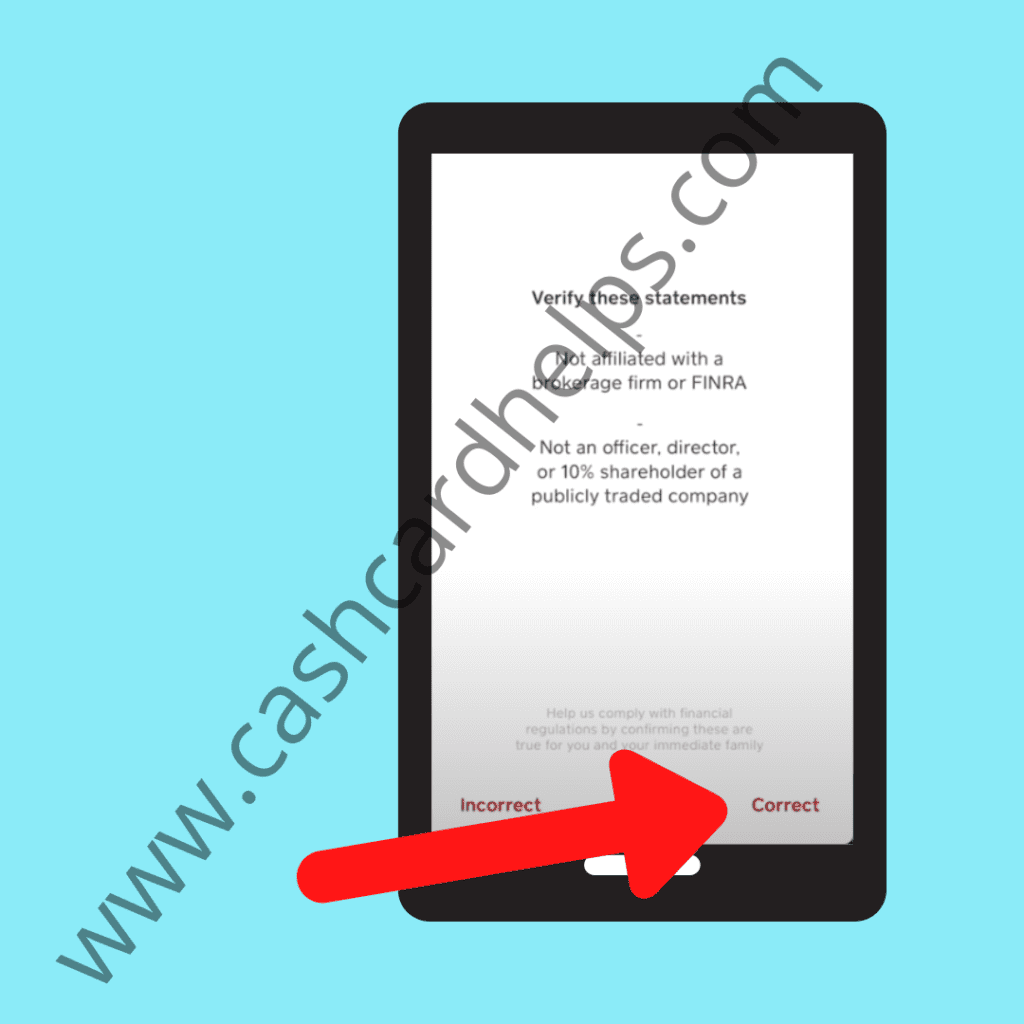

- Now, tap on the “Correct” option.

- Enter your Cash App PIN or Touch ID.

- Tap on the “Confirm.”

- Lastly, click the “Done” button.

Moreover, you can also set up a custom order to buy and sell stocks & bitcoin. Get to know How to set up a custom order on Cash App to automatically buy and sell Bitcoin and Stock.

Is it safe to buy stock on Cash App?

Although the app is free, trading stocks on Cash App carries some risk. Like all other investing platforms, this app has a limited trading volume. Investors who hold investments for over one year will be subject to a lower tax rate than those with shorter-term investments. This app offers attractive features, such as limited-time promotions and a safe way for you to purchase stocks.

It is safe as Cash App uses a one-time login code and encrypts all data transfers. The app monitors your accounts for fraud. The app uses Square’s point-of-sale technology. You will also need to input a one-time login code to purchase stocks. Transactions can be confirmed by touch ID or fingerprint scanning. Cash App automatically verifies transactions, but there are limits on the amount that you can purchase.

Cash App is a way to buy stocks daily. However, it lacks security options as compared to other online brokerages. Cash App supports stocks with a market capital of at least $1 billion and a daily average trading volume of 5 million or more. This app allows you to only invest in low-risk stocks.

What happens if I cash out my stock?

You may ask yourself: What happens if you want to cash out your stocks? You have options to cash out your stock with Cash App. Once you cash out your stocks, you can use Cash App to store your cash or deposit it directly into your bank account.

Cash App allows you to choose a preset amount or enter a custom amount when you buy stock. You can cash out your stocks once the market opens. You can stop withdrawing your stocks anytime, even though they won’t be able to sell out immediately. You can also set up automatic stock purchases, so you don’t have the hassle of making them manually each time.

How do you get money from stocks on Cash App?

Perhaps you have heard of day trading and wondered how to use the Cash App. Day trading involves buying and selling the same stock at the exact same price on the same market day. Day trades should be avoided. Some companies pay dividends, but others don’t. It doesn’t matter when you trade; it will impact your balance.

It is a straightforward process here. The platform will calculate how much to invest based on the stock’s performance, dividends, and price history. You can choose to invest in just a fraction of the share if you are not an experienced investor. You can still make a profit with a modest amount of money. You shouldn’t invest too much unless you are a professional investor. However, the platform will help you get started quickly.

The 5% rule is something you need to know before you start investing in Cash App. This rule states that no investor should place more than 5% of their portfolio on one risky investment. It would be best if you diversified your portfolio to ensure that you don’t lose money on one stock and that losses offset the gains of other assets. Cash App also requires that you verify your identity before you can trade. This app offers PIN entry and fingerprint scanning options for verification purposes.

Before we end this post on Cash App Investment, we encourage our readers to look at a short video presentation on how to buy & sell stocks & Bitcoin on Cash App

CONCLUSION

This post describes everything about Cash App Investment. We hope this blog will surely help the Cash App users to invest in Bitcoin and Stocks easily.

If you still have any doubts or queries, feel free to contact us for further assistance.

FREQUENTLY ASKED QUESTIONS

What is the Cash App Investing fee?

The Cash App has two types of charges when selling or purchasing BTC. The first fee that the Cash App applies is the Service fee, and the other is a transaction fee. As these fees are dynamic, it is visible while selling or buying Bitcoin. However, investing in stocks is entirely free.

How do I check Bitcoin progress on Cash App?

Follow these steps to check the Bitcoin progress.

- Tap the Banking tab at the Cash App home screen.

- Hit the “Bitcoin” option.

- Scroll down and go to the Bitcoin Limits section.

- Click the Bitcoin Limits option.

Can I invest $1 through the Cash App Investment?

Yes, the Cash App users can start the investment from as low as one dollar.

![Legit Cash App Surveys For Money [Highest Paying]](https://www.cashcardhelps.com/wp-content/uploads/2022/07/Untitled-1200-×-628px-2022-08-04T174048.508-768x402.png)